Have your cause officially recognized with a charity number

Do you want to take another step by embarking on the process of obtaining a charitable number for your organization? In addition to having your organization officially recognized, you can issue tax-deductible receipts to your donors.

To succeed in this process, we provide you with our legal services and the expertise of our lawyer.

Why get a charity number

for your organization?

Are you a public or private foundation created and residing in Canada? It is possible for you to register as a charity with the Canadian government. This registration will allow you to pursue your objectives and missions which are defined by the legislation. Also, you will be recognized by federal and provincial authorities.

Obtaining this recognition will allow you on the one hand to be exempted from income tax and on the other hand to issue tax receipts, entitling your donors to benefit from the tax credits provided by tax laws.

How can we help you in this process?

1

The complete management of the application process for obtaining a charity number for your organization

Our team is there to help you build the dossier that you will have to file with the Charities Directorate of the Canada Revenue Agency. First, we will help you identify the jurisdiction, either provincial or federal, depending on your field of activity. Then, we will accompany you step by step in the preparation of your request.

Jurisdiction identification

Presentation and description of your mission and its objectives

Collection and

sorting of essential documents

Preparation and follow-up of letters patent applications

Revision of the general regulations and your mission

The processing time for the application for a charity number (or RR number) by the Canada Revenue Agency is 8 to 12 months.

Remember that you are addressing government bodies. It is therefore essential for you to be rigorous and precise when creating your dossier to avoid wasting time or forgetting certain documents.

Are you ready to move on to a new stage for your organization? Make an appointment now with our expert to discuss the charity number (RR number).

Application to the provincial versus the federal

When applying for a charity number for your organization, you need to determine whether you are applying at the provincial or federal level. To help you make the right choice, we analyze your field of activity and the community you serve. Two things to remember:

- If you identify yourself provincially, register it in the constitution of the non-profit legal person with the Registraire des entreprises du Québec. Then, the request for recognition as a charity is made to the Canada Revenue Agency (CRA).

- If you identify yourself federally, everything is done with the Canada Revenue Agency (CRA).

Obtaining a charity number has many advantages. Indeed, it allows you to issue official donation receipts to your donors in order to obtain a tax credit provided for by law.

Resources to consult in Organizational Management

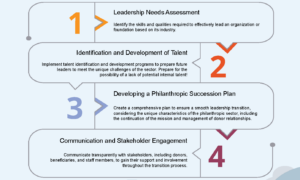

Succession Planning: an essential lever for securing the future of NPOs

BNP Inspire unveils the results of its first national study on Succession Planning in the philanthropic sector, conducted with the participation of 188 organizations across

Highlights of the 2024-2025 Federal Budget

On April 16, 2024, the Minister of Finance, Chrystia Freeland, presented the federal government’s budget for the 2024-2025 fiscal year. This article highlights the key

Succession Planning: Ensuring the Continuity of Leadership In the Organization

Succession planning is a crucial step for any organization or foundation, regardless of its field of activity. It is undoubtedly a sound risk management practice